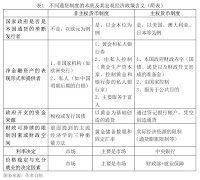

Chart 1: The Role of Private Accounts in Offsetting Benefit Reductions

Defined Benefits ↓ | Notional Account ↓ | ← | Diverted payroll contributions are double-counted in parallel accounts (during working years) | → | Private Account ↓ | |||

Calculated using inflation-indexing to determine the "bend points" ↓ | Accumulates interest at the rate of return on Treasury bonds ↓ | ↓ Accumulates interest at the nominal portfolio rate of return less annual fees ↓ | ||||||

| ↓ | ↓ | ↙︎ | ↓ | ↘︎ | ||||

| ↓ | ↓ At Retirement: Annuitized at no cost to provide a constant real monthly benefit ↓ | ↓ At Retirement: Partially annuitized to cover the shortfall in the defined benefit after "clawback" (if any) ↓ | ↓ At Retirement: Fully annuitized if the account is too small to provide poverty-level of benefits | ↓ Upon Death: Passed on to heirs if the defined benefit after "clawback" is sufficient to provide poverty-level benefits or the worker dies before retiring | ||||

| ↓ Defined benefit les amount | less | ↓ Constant real monthly benefit equals | equals | Benefit after "clawback" | plus | ↓ Annuitized portion of the private account ↓ | equals | Monthly benefits at poverty level |

This would be the guaranteed benefit to those who do not establish a a personal account ① | Actual payment from government received by those who choose personal accounts | ↓ Any portion not annuitized can be passed on to heirs |

コメント

コメントを投稿